Hot wallets vs. cold wallets: What is the difference, and which is safer?

Discover the key differences between hot and cold wallets for cryptocurrency storage. Learn how each type ensures the safety of your digital assets and which one suits your needs best.

What is a hot wallet?

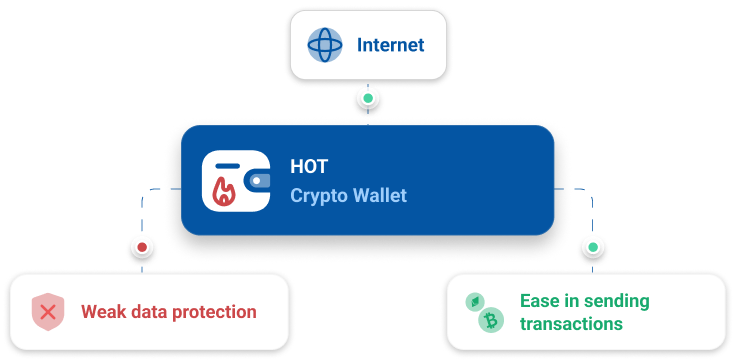

A hot wallet allows users to access and manage their funds via the Internet. Crypto enthusiasts who make frequent transactions prefer to use this type of wallet. Accessing crypto for trading or spending is more convenient than an offline wallet.

Meanwhile, hot wallets are more vulnerable to hacking and other cyber threats since they are online.

Types of hot wallets

- Exchange Wallets: Offered by cryptocurrency exchanges to store funds for trading purposes.

- Mobile Wallets: Apps on smartphones for easy access to cryptocurrencies on the go.

- Web Wallets: Accessible through web browsers.

Advantages and disadvantages of hot wallets

Hot wallets provide easy access to cryptocurrencies for daily transactions and trading activities. They feature a user-friendly interface and compatibility with various devices, making them a popular choice for quick exchanges of digital assets.

However, due to their constant connection to the internet, these wallets are more vulnerable to hacking and phishing attacks. This is why many cryptocurrency businesses use crypto processing systems to secure transactions and minimize risks. For example, Binance relies on login credentials and email-based password recovery, making it a potential target for hackers.

It is important to note that not all hot wallets are the same, and choosing a reliable solution plays a key role in protecting funds.

Popular hot wallets

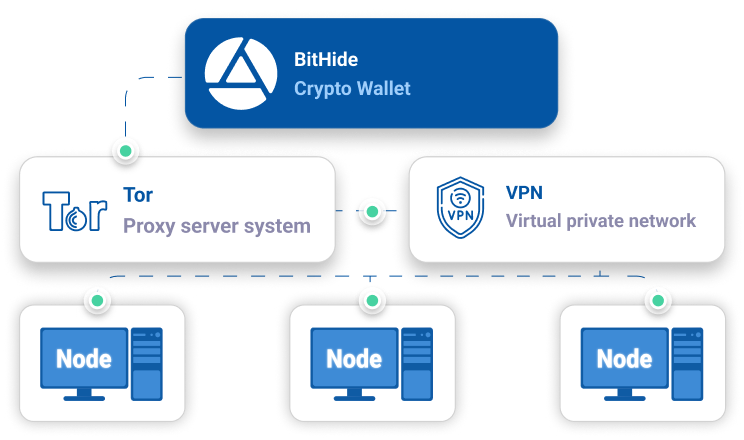

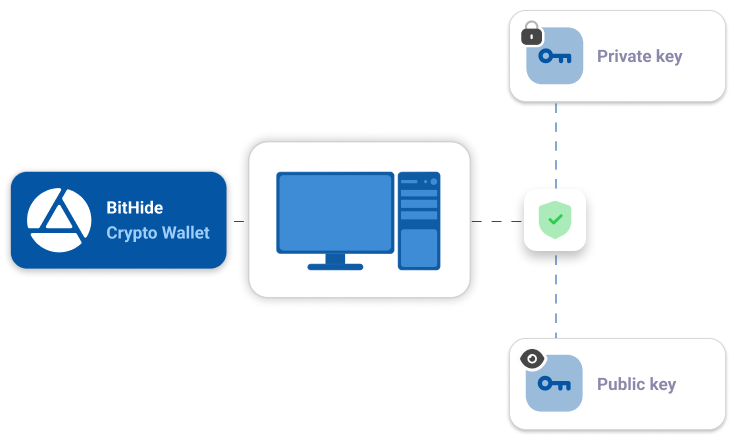

- BitHide. On security, BitHide sets the bar high as the best hot wallet option for corporate users. First of all, it’s stored on your private server, making it as secure as your server. Your crypto wallet's safety is essential, and BitHide ensures it by storing private keys on your servers. With advanced encryption technologies like VPN and TOR, BitHide hides your IP address from hackers. Moreover, BitHide offers crypto processing, a secure backup option, convenient reporting, and multi-merchant accounts.

- CoinPayments. It enables an extraordinary number of tokens (2,300). At the same time, the wallet doesn’t use the open code behind, so you really need to trust the company to store it here.

- Coinbase. A multi-currency wallet with a mobile app. However, there is no desktop version.

Best practices for protecting hot wallets

Since hot wallets are more vulnerable to phishing attacks, we advise corporate users to consider these approaches for protecting their hot wallets:

- Safeguard IP address. Use on-prem wallets like BitHide and store all transaction data on your private servers. The advanced VPN and TOR technologies utilized by BitHide conceal your IP address.

- Enforce data backups. BitHide provides secure data backups for protecting your company's digital assets. You can restore data with regular backups of private keys from a reserve server backup.

- Foster cybersecurity awareness. Educate your corporate team about phishing scams. Encourage them to verify website authenticity before providing any sensitive information.

What is a cold wallet?

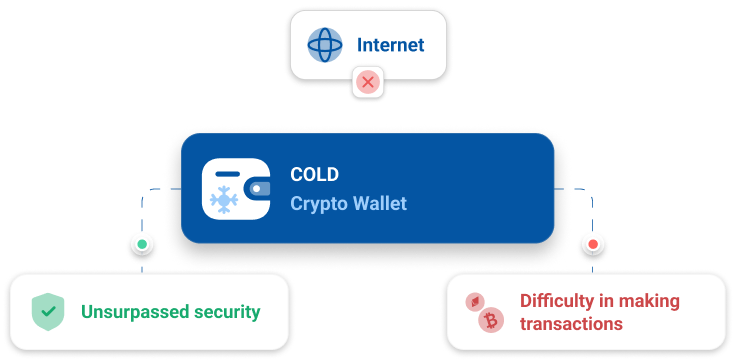

A cold wallet is a hardware device not connected to the Internet. It protects against online threats by keeping your cryptocurrency offline, significantly enhancing security. Unauthorized access to your funds is also nearly impossible, making this option ideal for long-term storage and investment protection.

However, this type of wallet does not meet corporate needs, as it cannot generate invoices or serve customers online 24/7. For businesses that conduct transactions regularly, it is more important to use the best crypto wallet for business, which ensures payment automation, a user-friendly interface, and round-the-clock availability.

Types of cold wallets

- Hardware Wallets: Physical devices with offline private keys.

- Paper Wallets: Printed or written records of your private keys.

- Offline or Air-Gapped Computers: Computers or devices that never connect to the Internet. Their sole purpose is to store and manage cryptocurrency keys securely.

Advantages and disadvantages of cold wallets

Cold wallets offer unmatched security by storing private keys offline. This safeguards against hacking and phishing attacks. They provide a reliable solution for long-term asset protection. They are ideal for corporate users with significant cryptocurrency holdings.

On the other hand, they are inconvenient for businesses requiring frequent transactions. They involve extra steps to access funds. Moreover, they need technical expertise for proper setup and management. It poses a potential challenge for some corporate users. Hardware wallets, a common type of cold wallet, can be vulnerable to physical damage. They are often subject to loss or theft.

Popular cold wallets

- The Ledger Nano S is known for its robust security features. It offers offline storage of private keys and supports a wide range of cryptocurrencies.

- Trezor Model T prioritizes security and supports many cryptocurrencies. Its touch screen allows for easy navigation.

- KeepKey is a hardware wallet with a sleek design and a large screen for easy transaction verification. It offers offline storage and supports a variety of digital assets.

Best practices for protecting cold wallets

Some best practices include:

- Offline Storage. Keep your cold wallet entirely offline to cut exposure to online threats.

- Secure Physical Location. Prevent physical theft or damage.

- Multiple Backups. Create many copies of your private keys and store them in different locations.

- Regular Updates. Keep your cold wallet software and firmware up to date. The latest updates usually have the best security features.

- Limited Access. Restrict access to your cold wallet and private keys only to authorized personnel.

- Secure Communication. Use secure channels for any communication related to your cold wallet. Avoid public Wi-Fi or unencrypted networks.

Hot wallets vs. cold wallets

Which Wallet Is Better: Cold or Hot?

The answer depends on your needs. If you need easy access for your team and a highly secure wallet, use the BitHide hot wallet. However, if your priority is full control over funds without third-party involvement, consider a non-custodial crypto wallet, which provides maximum independence and security. Choosing a cold wallet is better if you prioritize even more excellent protection and are willing to sacrifice convenience.

Security

Hot wallets expose users to higher security risks due to their online connectivity. However, cold wallets may be less suitable for frequent transactions due to their extra steps to access funds.

Accessibility and convenience

Hot wallets offer high accessibility and convenience. Internet connectivity allows users to instantly access their funds from various devices. That is what makes them popular among corporate users who need fast access to their crypto.

Cold wallets rank security over accessibility. They store private keys offline, disconnected from the Internet. It provides a higher level of protection against online threats but makes them inconvenient when processing many transactions.

Use cases

While private users can use both types of wallets for the same type of use cases, the cases for using hot vs cold wallet differ for corporate users.

Hot Wallet Example

- Customer Transactions: Accepting cryptocurrency payments for goods and services.

- Payroll Processing: Efficiently distributing employee salaries in cryptocurrencies.

- Supplier Payments: Promptly settling payments to suppliers and vendors using crypto.

Cold Wallet Example

- Corporate Reserves: Safely storing corporate reserves in cryptocurrency for diversification.

- Institutional Investors: Managing large cryptocurrency holdings for investment firms.

- Security Token Offerings: Holding tokenized assets for crowdfunding campaigns.

Frequently Asked Questions

How are cryptocurrency hot wallets different from cold wallets?

Cryptocurrency hot wallets and cold wallets differ mostly in their online accessibility. Hot wallets are connected to the Internet. It is convenient for frequent transactions and trading. However, their online nature exposes them to higher security risks. On the other hand, cold wallets are offline, providing enhanced security but requiring additional steps to access funds. Hot wallets prioritize accessibility, while cold wallets prioritize security. Choose the wallet type based on your usage and risk tolerance.

Are hot wallets much safer than cold wallets?

Let’s compare cold vs hot wallet. Cold wallets are generally safer than hot wallets. Why so? It is due to their offline nature, which reduces the risk of hacking. Likewise, unauthorized access to private keys and funds is impossible. The corporate world values cold wallets better because of their ability to keep private keys offline, away from potential online threats.

How safe is a hot wallet?

The safety of a hot wallet depends on various factors. It includes the security measures implemented by the user and the wallet provider.

Hot wallets are working on their soft to reach the level of security for cold wallets. So, if a hot wallet can offer you extended security features like:

- to hide IP address

- backup option

- dangerous transaction monitoring, etc.

Is a cold wallet better than a hot wallet?

Hot wallets vs cold wallets is a difficult choice. A cold wallet is generally better when prioritizing security for long-term storage. The offline nature of cold wallets provides enhanced protection against hacking and cyber threats.

On the other hand, hot wallets are more suitable for users who require frequent access to their funds. For example, there are doing daily transactions and trading. The two choices depend on the user's specific needs, risk tolerance, and usage frequency.

For a balance of security and convenience, consider strategically using both wallets.

Can I use both a hot and a cold wallet?

Using both a hot and a cold wallet is a smart and secure approach to managing your cryptocurrency.

Why are hot wallets free and cold wallets aren't?

Hot wallets are typically free or lower in cost because they are software-based solutions that are easier and cheaper to develop and maintain.

Which type of wallet is recommended for long-term storage of cryptocurrencies?

If you don't plan to make frequent transactions, go for cold wallets. If otherwise, find a hot wallet that will fit your needs.

Conclusion

To sum up, for choosing hot wallet vs cold wallet, we suggest considering your needs:

- Is it a personal or corporate account?

- How many transactions a day/month it needs to process?

- What is the required level of its security?

- What crypto do you want to store there?

By answering these questions, you can make the best choice.

Let's consider how it works using a real-life example. You need a corporate wallet to store Ethereum. The solution must be highly secure as you fear your money will be stolen. The wallet's IP address must be hidden if it's a hot wallet. In this case, BitHide is one of the best options as it is highly secure, convenient, and affordable.

If you'd like to learn more about how it works and its benefits, please read here or contact us directly.