Full Guide on DeFi Projects: Lending, Staking, Liquidity Pools, and More

Overview of popular DeFi platforms: Aave, Compound, Pendle, Curve, USDe.

Decentralized Finance (DeFi) is a new financial system that is built on the blockchain, where users communicate with smart contracts without intermediaries or banks.

In this article, we’ll break down the primary varieties of DeFi projects, including lending, liquidity provision, and automated yield techniques, each with one-of-a-kind risk and return profiles. Also, we’ll spotlight predominant structures and offer suggestions for deciding on tasks that align with your goals and threat tolerance.

Lending & Borrowing Protocols

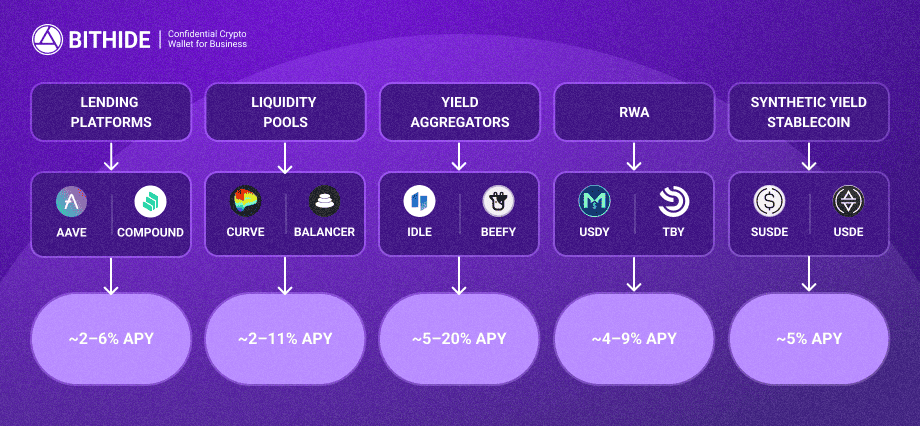

Probably the easiest way to earn money in DeFi is through lending protocols like Aave and Compound. These DeFi projects will allow you to place your crypto into liquidity pools that others can lend out. You are paid interest in exchange for a savings account, but usually, at a higher rate. The matching process is done through smart contracts, and interest rates are adjusted according to supply and demand.

As an example, when demand to borrow USDC increases, the interest rate also increases for lenders of USDC. When the supply is more than the demand, the rates decline. Yields on stablecoins (examples: USDC, USDT, DAI) are generally between 2-6 APY, but may temporarily reach higher rates during market stress or incentive periods. More unstable assets, such as ETH, can provide higher, yet less reliable returns.

Notably, lending protocols such as Aave and Compound are non-custodial, and your crypto remains in your own wallet and is merely locked in smart contracts, but it is not under the custody of a third party.

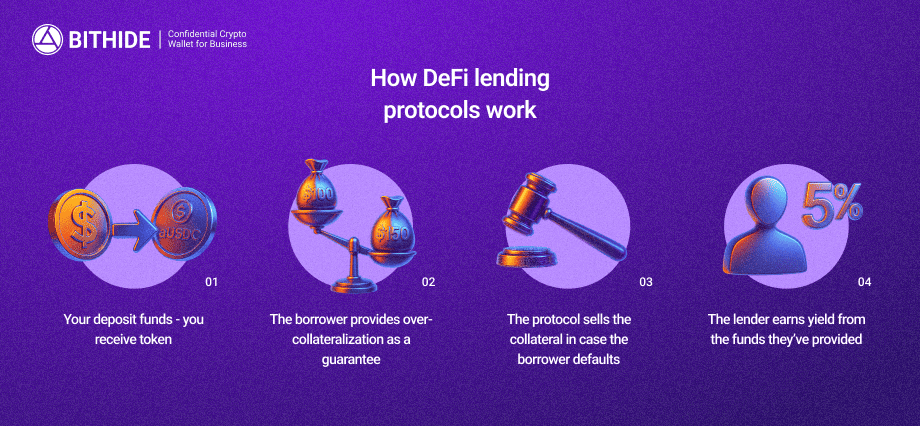

When you put money in, you get a token that is your share (aUSDC on Aave). Borrowers are required to over-collateralize, which is usually putting up $150 of crypto to borrow $100. The protocol sells its collateral to save lenders if they default.

Lending is not, however, without dangers:

- Smart contract risk: a bug or exploit to drain the pool. We covered in detail how DeFi gets hacked in this article.

- Liquidity risk: a sudden redemption or decrease in TVL can cause delays.

- Collateral risk: loans may not be covered entirely by collateral in the case of a crash.

- Interest rate risk: yields may drop when there is a drop in demand for borrowing.

The leading DeFi projects, such as Aave (which by mid-2025 had over $30 billion TVL), are resilient, yet it is always worth reviewing a platform's security audit and insurance components. On the whole, lending can be a comparatively low-effort approach to passive income generation. However, risk management and platform reputation do count.

Yield Management and Fixed-Rate Protocols (Pendle Finance)

The yields of most DeFi platforms are variable, yet there is an attempt to provide fixed or more predictable yields through some protocols. These platforms are based on dividing the yield-bearing assets into two components: a principal and a yield component, thus allowing fixed-income products on-chain.

Pendle Finance is one of the best examples. When you put in a yield-bearing token (such as aUSDC or stETH), Pendle splits it into:

- Principal Token (PT) — redeemable 1:1 at maturity.

- Yield Token (YT) — is a representation of future interest and can be sold or exchanged.

Selling your YT upfront means that you secure a fixed rate of return. The buyer assumes the risk of yield in the hope of gaining a higher amount of variable returns. The profit will be the difference between the discounted PT price and the full redemption value.

Other protocols, however, more elaborate than regular lending. They include:

- Element Finance has both fixed and variable tranches in pooled strategies.

- APWine introduced future yield sales and yield speculation mechanics.

Risks include

- Protocol risk — should the underlying asset go down (e.g., Aave is hacked), PT and YT can go down.

- Liquidity risk — PT and YT deal with niche markets; premature withdrawal can be expensive. Such protocols tend to have a lower TVL than lending protocols, which implies that not as much capital can be used to trade or redeem — it is particularly true in volatile markets.

- Smart contract risk — there are increased attack surfaces when two or more contracts interact.

Fixed-yield protocols provide very strong yield management, but also entail a solid grasp of token dynamics, duration risk, and the trustworthiness of the platform.

Stablecoin Strategies: Lending, Farming & Innovations

Stablecoins — tokens pegged to fiat currencies like USD — are a popular choice for DeFi users seeking yield without crypto price volatility.

Lending Platforms (Aave, Compound)

Some of the DeFi protocols, such as Aave, Compound, and MakerDAO DSR, allow you to deposit stablecoins and get interest from borrowers. Interest rates are usually between 2-6% APY, and they vary depending on the demand.

Liquidity Pools (Curve)

Supplying stablecoin-stablecoin pools (e.g., Curve USDC/USDT/DAI 3pool) generates swap fees and usually token rewards as well. The pools also experience limited impermanent loss since the price is stable, and in some cases, it generates a better yield than plain lending.

Yield Aggregators (Yearn)

Yearn, Idle, and Beefy are DeFi platforms that automate stablecoin strategies by distributing funds among lending and liquidity pools to maximize earnings. They auto-compound returns, have a performance fee, and add smart contract layers.

RWA (Real-World Asset) Stablecoins

New products such as USDY by Ondo Finance provide passive yield with the backing of U.S. Treasuries. Unlike USDC, which does not earn interest, USDY earns value over time, like a tokenized money market fund. Access can, however, be limited by both geography and regulation.

Synthetic Yield Stablecoins (USDe)

Investments such as USDe by Ethena Labs provide good returns (reportedly up to 30% APY, though that was only at the early stages of the projects — as of this writing, the yield is around 5%) through onchain trading mechanisms. These models are tempting, but they are also quite risky: smart contract failure, peg instability, and market dependencies.

In short, stablecoins present a variety of income choices, including conservative and experimental. Never enter into any situation without evaluating the risk-reward equation, and never invest in any strategy that you do not fully comprehend.

Providing Liquidity on Automated Market Makers (and Earning Fees)

The other trendy method to make money in DeFi is to be a liquidity provider (LP) on decentralized exchanges that run on automated market makers (AMMs) such as Uniswap, Curve, or Balancer. You put pairs of tokens into a pool, which traders exchange assets with. You are rewarded with a share of the trading fee in exchange.

How AMM Works

A classic AMM, such as Uniswap v2, requires you to deposit an amount of each of two tokens (e.g., ETH and USDC). The pool automatically adapts the prices according to a fixed formula for the product. LPs are rewarded a proportion of the trading fees (e.g,. 0.3% per trade on Uniswap) according to their proportion of the pool.

The DeFi platforms are also permissionless and non-custodial, which means that anyone can add liquidity and have full control of their money at any given time.

Impermanent Loss (IL)

Token prices change, and the AMM rebalances your position, which usually results in you having more of the weaker asset. This can decrease your total value as compared to just holding. That is why it is called impermanent, as it does not survive in case prices come back. However, in many cases, they do not. Nevertheless, in active pools, IL can be compensated by trading fees.

In the case when LPing is advantageous:

- Stablecoin pools (e.g., USDC/USDT) have minimal IL and steady fee income.

- Correlated asset pools (e.g., ETH/stETH) limit divergence risk.

- High-incentive or high-volume pools may offer extra token rewards or strong fee income.

Risks: In addition to IL, there is smart contract risk, token failure risk (e.g., rug pulls), and exposure to volatility. It is also possible to manipulate low-liquidity pools.

Providing liquidity may be lucrative, particularly on stable or rewarded pools, but it needs diligent pool selection and attention. To novices, it is better to start with stablecoin pools on reputable platforms, such as Curve.

Using Yield Aggregators: Set-and-Forget Earning

DeFi has a lot of yield opportunities. However, it is difficult to manually track rates, claim rewards, and rebalance. This is mechanized by yield aggregators such as Yearn Finance, Beefy, and Idle Finance, so that users can generate the most optimized returns with the least amount of effort.

How Yield Aggregators Work

Users put money into vaults, and the smart contracts manage the capital in the best-yielding strategies of protocols such as Aave, Compound, and Curve. Similar to these vaults, there are auto-compounding rewards that allow converting reward tokens, such as CRV or COMP, to the underlying asset and reinvesting to increase yield. The majority of aggregators follow the non-custodial principle — your money is handled through smart contracts, not intermediaries.

As an example, a Yearn DAI vault can transfer funds between lending and liquidity pools, selling its rewards automatically to DAI. Beefy uses the same logic to farm LPs on many different chains and compound rewards such as CAKE or BAL. Idle Finance provides the strategy of Best Yield and Risk Adjusted, and even tranches, to users who have varying risk tolerance.

Only use reputable sites with a clear governance process and a good audit record. Aggregators used with discretion provide a set-and-forget method of earning in DeFi.

High-Risk and High-Yield Strategies

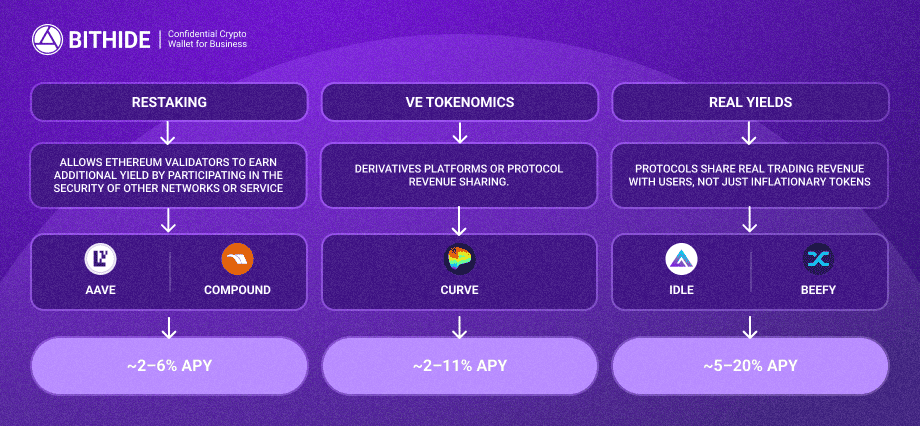

In addition to the more traditional DeFi tools, there are some riskier, yet more profitable approaches on less established or low-liquidity systems. These are real yield, restaking protocols, and experimental governance-based incentives.

Real Yield Platforms (Arbitrum, Synthetix)

Similar protocols, such as GMX (Arbitrum, Avalanche), share actual trading revenue not only inflationary tokens. Staking GMX or providing liquidity through GLP rewards with ETH or AVAX in the form of swap and leverage fees. The GLP holders are counterparties to the traders. Іn case of loss, traders will gain, and vice versa. The returns are in the double-digit level, although the market exposure and volatility are great. Synthetix and Dopex are other examples of real yields.

Restaking (EigenLayer, Karak)

Restaking allows Ethereum stakers to gain additional yield by staking new networks or services. The layered reward is through the ability to reuse staked ETH to validate other protocols with EigenLayer. Karak is spreading restaking into various chains.

Yields are stackable, but the risk of slashing is intense. Bad action or staking failures can burn staked assets. These are complicated, illiquid, and are most appropriate to experienced users.

Other Strategies

More advanced yield options are veTokenomics (e.g., locking CRV or BAL to gain voting power or bribes), a derivatives platform, or protocol revenue sharing. These can be tempting to invest in, although they are typically exposed to governance and smart contract risk and have an exit liquidity problem.

Such approaches are not necessary for the majority of users and are much more risky. By venturing into them, employ a small amount of capital, do your research well, and know the worst that can happen.

Choosing the Right DeFi Strategy

DeFi does not have a universal solution. The best approach is determined by how much risk you are willing to take, capital, time, and liquidity requirements. The following table provides a comparative analysis of the key DeFi earning ways to assist you in making the right decision:

| Strategy | For Whom | Expected Yield | Risk Level | Effort | Liquidity |

| Stablecoin Lending (Aave, Compound) | Low-risk users, business | 2–6% APY | Low | Low | High |

| Liquidity Pools (Uniswap, Curve) | Medium-risk users | 2–11% APY | Medium (IL, volatility) | Medium | High (for major pools) |

| Fixed Yield (Pendle, Element) | Сonservative users | 5-20% APY | Medium | Medium | Medium to Low |

| Yield Aggregators (Yearn, Beefy) | Passive users, beginners with capital | 4–15% APY | Medium (depends on vault) | Low | Medium to Low (vaults) |

| Real Yield / Restaking (GMX, EigenLayer) | Advanced users with high risk tolerance | 5% APY | High (market + smart contract + slashing) | High | Low (can be illiquid) |

| Custodial Options (Binance Earn, SwissBorg) | Businesses or beginners | 3–10% APY | Medium (custodial, platform risk) | Low | High |

Conclusion

DeFi has a large variety of instruments to produce yield on crypto, starting with easy lending and reaching more complex and high-yield strategies.

There are no guarantees on returns. High APYs are likely to indicate high risk. Even the so-called conservative strategies are based on assumptions that can fail under pressure. This is why it is prudent to begin with a small scale and test famous sites and remain updated.

Importantly, most DeFi protocols are non-custodial. You interact without delay with smart contracts from your own wallet, retaining control of your assets. But some custodial models also exist, particularly for beginners or establishments. Structures like Binance Earn or SwissBorg offer simplified access to DeFi yields while protecting the custody of users' belongings.

If you need a non-custodial crypto wallet built specifically for businesses, visit the BitHide homepage.

Disclaimer: This material is for informational purposes only and does not constitute individual investment advice.