The Coinbase Hack: Full Details and What It Means for Businesses

Coinbase data breach: what you need to know

The list of crypto hacks 2025 was updated with another case. Attackers accessed personal data from nearly 70,000 users of the leading US crypto exchange Coinbase. Some hacked Coinbase users even ended up transferring their funds to fraudsters. The estimated damage ranges between $200 and $400 million.

This comes shortly after another big announcement. In May, Coinbase became the first crypto company to join the S&P 500 index. Following news of the data breach, Coinbase stock dropped by 7%, and crypto investors were once again reminded of the risks of holding assets on centralized platforms.

This article covers what’s known about the Coinbase data breach, how the breach occurred, and why businesses should explore non-custodial solutions. We also share advice on how to protect crypto assets.

Key Takeaways

- Coinbase was targeted in repeated cyberattacks since December 2024. The Coinbase hack affected users but it wasn't disclosed until May 2025.

- The attackers used phishing attack tactics and social engineering to manipulate support staff.

- Coinbase is working with US authorities, compensating affected customers, and tightening its crypto security breach protocols. The company has launched a $20 million bounty fund for information leading to the hackers.

- Custodial platforms will continue to face breaches due to how client data is stored. For handling digital assets, non-custodial solutions are safer.

The Crypto Exchange Hack at Coinbase: What Happened

On 15 May 2025, Coinbase officially reported to the SEC that 70,000 users were affected in a Coinbase hack incident involving personal data theft. The company is now facing lawsuits, financial compensation claims, and cybersecurity reforms.

When the Data Breach Occurred

In December 2024, attackers bribed Coinbase support staff based outside the US, gaining access to customer base. The following personal data was compromised:

- full names,

- home addresses,

- phone numbers,

- email addresses,

- last four digits of Social Security numbers,

- partial bank details,

- ID images,

- wallet balances and transaction histories.

Crucially, passwords, private keys, and funds were not accessed.

How Users Were Targeted

The stolen data allowed attackers to deceive many users. Using phishing attack tactics, they pretended to be Coinbase security staff, calling users and requesting transfers to "secure crypto wallets."

The fraud campaign continued until May, when hackers demanded a $20 million ransom from Coinbase, threatening to release the data to the dark web. Coinbase refused and instead set up a fund of the same amount to reward leads that could identify the attackers.

Lawsuits from affected customers are now mounting. The main complaint: the company failed to notify users in time about the breach, which occurred months earlier.

How the Exchange Responded

Coinbase dismissed staff suspected of involvement in the breach, boosted security measures, cooperated with US law enforcement, and pledged to compensate affected users. All victims are being offered one year of free identity monitoring and protection services.

Despite these steps, the exchange is under scrutiny. It’s unlikely this will be the last high-profile crypto exchange hack. Centralized exchanges (CEXs) are prime targets for criminals.

That’s because they are custodial services — storing users' private keys and data on their own infrastructure. By breaching one platform, attackers can access thousands of accounts and assets. This is how Coinbase accounts were hacked.

The Risks of Custodial Platforms

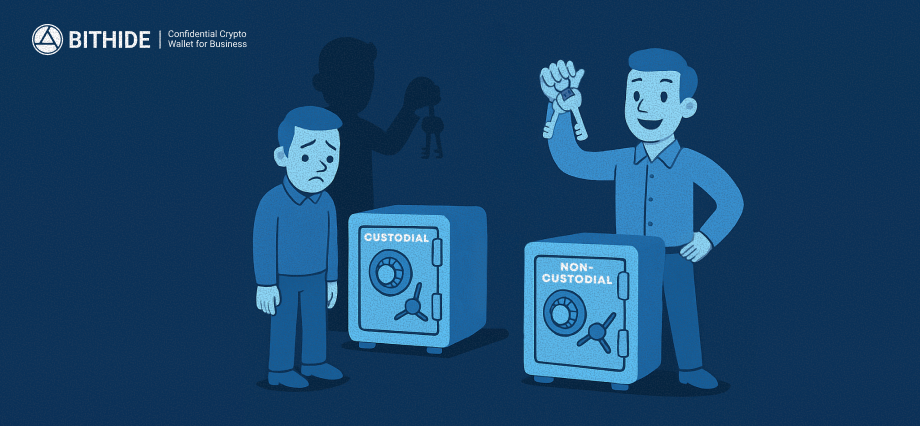

A custodial platform stores your cryptocurrency for you. You do not directly own your private keys — you’re trusting a third party, like a bank. That party is responsible for safeguarding your crypto and personal data, while giving you access via an app or website.

Here are three core reasons why custodial setups are vulnerable:

1. Risk of Platform-Wide Hacks

Custodial exchanges hold vast amounts of crypto and are regular targets for large-scale crypto exchange hacks.

Example: Bybit — one of the most well-known hacked crypto exchanges — lost $1.5 billion in February 2025. Users relying on centralised storage had no control over security measures — and lost everything in one breach.

2. No Control Over Your Assets

Using custodial services means giving up control. Your provider can:

- freeze your assets,

- pause withdrawals,

- disappear with your money.

Example: FTX, once the second-largest exchange, collapsed in 2022. CEO Sam Bankman-Fried misused client funds. The result: bankruptcy and billions in losses. He is now serving 25 years in prison.

3. Regulated ≠ User-Friendly

Centralized platforms must comply with regulatory demands. That means they can:

- freeze accounts without warning,

- restrict access "pending investigation",

- lock funds due to compliance checks.

Example: Binance has been known to block or freeze even clean accounts due to broad AML/KYC rules.

Custodial vs Non-Custodial Solutions

A non-custodial wallet means only you hold the private keys. You control your funds with no intermediaries. This is especially crucial for businesses dealing with crypto transactions.

Custodial wallets store funds on the platform’s servers. This setup is better suited for casual users making small transactions.

What Should You Choose?

For Personal Use:

We recommend non-custodial wallets like:

- Trust Wallet,

- MetaMask,

- OKX Wallet.

They’re convenient, portable, and independent of any centralized platform.

For Businesses:

You need solutions that allow for creating and managing an unlimited number of wallets (merchants), support automated bulk withdrawals, offer crypto AML checks, and provide easy-to-use financial reporting. Products like these would be a good fit:

- BitHide (a self-hosted crypto payment solution for business),

- Fireblocks (for large institutions).

How to Protect Crypto Assets: 7 Tips for Businesses

1. Use Non-Custodial Wallets

Retain full control over private keys — this reduces risks of hacks, scams, and freezes.

2. Keep Keys & Seed Phrases Offline

Never store them in phone notes, the cloud, or Telegram. Use offline managers, encrypted devices, or even physically split the phrase into parts.

3. Set Up Two-Factor Authentication (2FA)

Always use app-based 2FA (e.g., Google Authenticator), not SMS.

4. Separate Hot and Cold Wallets

Keep the assets you use regularly separate from your long-term savings. A hot wallet is for small, everyday transactions and should be easily accessible, while a cold wallet is for storing the bulk of your assets securely offline.

5. Screen Addresses and Counterparties

Use on-chain analytics or AML tools like BitHide to assess incoming funds — especially from third parties.

6. Avoid Suspicious Links and dApps

Phishing is one of the most common reasons people lose assets in crypto, especially in DeFi. Drainers, for example, can be bought by just about anyone for $100–300. Always double-check the website address, URL, and any connected permissions.

7. Limit Team Access Right

Set roles and transaction limits. Not everyone needs full access.

Final Thoughts

Even regulated giants can fall victim to hacks. You may not be able to completely avoid custodial services, but you can choose where and how to store crypto.

Non-custodial wallets give you total control and reduce risk. No one else can access your private keys or freeze your funds. BitHide helps protect your crypto assets — no intermediaries involved. Explore how BitHide can support your business and make your transactions fully confidential.