BitHide Case Study: Transparent Crypto Accounting for Business Payments

Solving crypto accounting challenges for finance teams.

For many companies, adopting crypto payments is the next logical step. Fast, borderless, and modern: it is an upgrade from traditional banking. But in practice, it often turns into chaos.

Once cryptocurrency enters daily business operations, accounting teams face confusion, blocked transactions, missing records, and countless human errors. Payments disappear in blockchain explorers, reports stop matching, and no one can say exactly who sent what, when, or at what rate.

That’s what happened to an PSP company that turned to BitHide for help. They wanted to keep using crypto for salaries and partner payouts, but also gain full transparency, control, and proper blockchain accounting.

The Challenge: When Crypto Payments Break the Accounting Flow

In early 2025, an PSP company with over 100 employees transitioned most of its settlements, from affiliate rewards to contractor payments, to cryptocurrency. The idea was simple: save on conversions, avoid delays, and simplify cross-border payouts.

But after the first few months, the finance department started facing painful questions that no one could confidently answer:

- Who exactly sent each transaction, and from which wallet?

- Where is it documented?

- What was the blockchain fee and token exchange rate at the time of payment?

- Did this transaction actually make it into the accounting system?

The more the company relied on crypto, the less control it had over its finances.

Every payment had to be manually verified across multiple wallets and block explorers. A single typo in a wallet address meant irreversible loss of funds. Accountants spent hours taking screenshots, copying hashes, and reconciling them with spreadsheets. And even the smallest mistake — such as sending a token to the wrong network or mismatching ERC-20 and TRC-20 standards — could result in transactions failing or crypto being permanently lost.

By March 2025, month-end reconciliation took more than three full working days. Reports from HR and affiliate teams didn’t match finance records — the numbers differed in every file. Some transactions went missing entirely, while others appeared twice. In just one quarter, more than $12,000 in payments had to be manually tracked and verified again.

Worse, there was no single point of truth. Managers could send funds from different business wallets, leaving no record of who approved or executed a transfer. Suspicious activity was almost impossible to detect because internal oversight tools didn’t extend to blockchain operations.

Crypto payments, once meant to simplify operations, had become an unmonitored zone, a place where accounting mistakes, human errors, or even employee fraud could go unnoticed. The company needed a way to bring order, traceability, and full transparency to its crypto payments, without sacrificing speed or privacy.

The Solution: Turning Blockchain Data into Business Clarity

BitHide didn’t just add “another wallet.” We deployed a business crypto payment layer on top of the company’s operations. In this single interface, finance, accounting, and ops can send, track, verify, and export everything that happens on-chain.

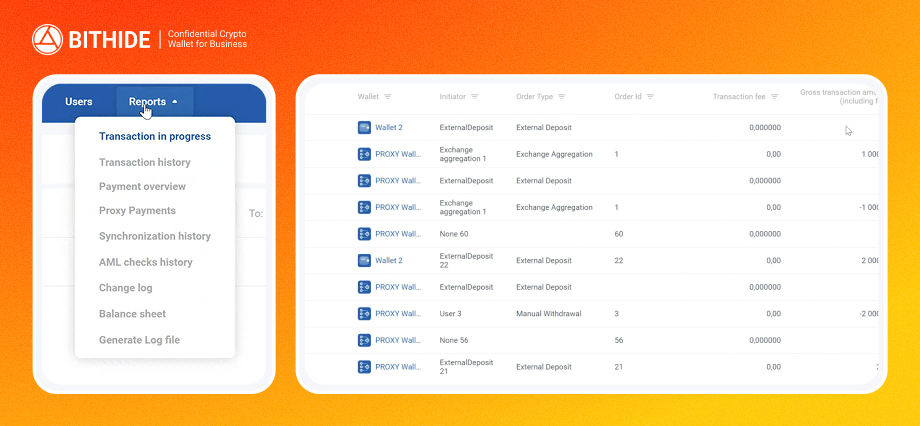

It organizes every data stream a finance team needs for crypto accounting:

- Transaction in progress — a live queue of outgoing and incoming transfers with real-time statuses (created → broadcasted → confirmed).

- Transaction history — a searchable ledger of every on-chain movement with hashes, sender wallet, recipient, network, token standard, fee, and timestamp.

- Payment overview — aggregated views for crypto financial management (totals by token/network, top counterparties, period comparison).

- Synchronization history — a system log to confirm all wallets are up-to-date with the chain and no events were missed.

- AML checks history — built-in due diligence. Each address or transaction has a risk score (0–100%), with categories and flags from our data providers, so compliance can verify before sending.

- Change log — who did what and when (roles, approvals, settings).

- Balance sheet — an accountant-friendly statement by asset and network for any period, ready for export or audit.

For the accounting team, the Balance sheet screen becomes the “single source of truth.” You can filter by date range, active vs. archive wallets, and drill down by cryptocurrency. Columns show Start of period → Income → Outcome → End of period — exactly how classic statements work, but for on-chain assets. One click exports the view to Excel (.xlsx) or CSV, so numbers flow directly into your crypto bookkeeping software with no manual copy-paste.

Two things make this especially useful for transparent crypto reporting:

- Context + evidence on one screen. For any line item, finance can jump to the transaction, see the rate snapshot and blockchain fee at the time of execution, check who initiated it (via the change log), and confirm it passed AML with a risk score below your threshold.

- Unified permissions. CFOs, accountants, and auditors get role-based access: they see what they need (reports, balances, histories) without full spending authority.

Operationally, BitHide replaces fragile spreadsheets with on-chain transaction tracking and workflow tools tailored for corporate use:

- Create and manage multiple business crypto wallets (by team, brand, region), with labels and access rules.

- Filter payments by date, wallet, network, currency, status, and counterparty to reconcile faster.

- Export any report (history, balance sheet, AML logs) to share with auditors or ingest into ERP/accounting.

- Monitor everything in real-time — pending vs. confirmed, fee levels, retries, and sync health.

In practice, the company’s financial process changed from “ask ops for a hash and hunt in a block explorer” to click → verify → export. Managers initiate transfers; finance approves and observes; accounting books from clean, structured data.

The result is transparency for companies without sacrificing speed, privacy, or control, exactly what corporate crypto payments should look like in production.

Results: 4х Faster Reports, 0 Errors, Full Transparency

Just one quarter after integrating BitHide, the company’s accounting workflow changed completely: measurable, visible, and stable.

Before, finance teams spent days matching spreadsheets with blockchain data. Now, reports that used to take hours are generated instantly and exported in two clicks. Every transaction, address, and network is automatically synchronized and visible in one dashboard.

Key results:

- 4x faster reconciliation. Month-end closing now takes less than one day instead of four.

- 0 human-factor errors. In over 2,800 transactions, no mismatches or duplicate entries were found.

- 100% blockchain visibility. Every transfer, fee, and AML score is logged and accessible in the Balance Sheet view.

- 50% less manual work. Finance managers no longer verify transactions through third-party explorers (all confirmations happen in BitHide).

- Seamless audits. Reports are exported directly to CSV or Excel with timestamps, risk scores, and exchange-rate snapshots, so auditors receive complete documentation instantly.

The finance department regained control and confidence in its crypto operations. Instead of chasing data across wallets and chats, managers now track live statuses, filter by wallet or date, and share clear reports with top management and partners.

For the first time, crypto payments became not just fast, but also fully transparent and accountable. The company’s CFO described the result best:

“We stopped treating crypto as a black box. With BitHide, it’s part of our financial system — traceable, transparent, and predictable.”

Conclusion

BitHide helped the company transform its crypto reporting from a confusing patchwork of spreadsheets and screenshots into a fully transparent crypto accounting system. Every transaction, wallet, and AML check is now tracked, logged, and exportable, giving the finance team complete confidence in every number they report.

Want your crypto payments to be auditable, fast, and under control?

Let BitHide show how simple accounting can be when built for business. Book a Demo to see how your company can turn complex crypto payments into structured, compliant financial operations.