ISO 20022: A New Era or a Digital Cage

ISO 20022 changes the rules: what awaits business and users in 2026.

On November 22, 2025, an event occurred in the global financial system that went unnoticed by most but changed the principles of all international payments. On this day, the SWIFT network fully transitioned to the new data exchange standard ISO 20022, completing a transition period that lasted several years.

What does this mean in practice?

Every day, approximately 44 million payments totaling $150 trillion pass through the SWIFT system. All these transactions now use a completely new information transmission format. For business, this means accelerating cross-border transfers by 40% and automating the processing of up to 90% of operations. But behind the efficiency lie serious risks to confidentiality.

In this article, we will consistently examine the technical essence of the transition, its impact on the speed and cost of operations, as well as how the new standard changes the rules of privacy in the financial sector.

Key Points

- On November 22, 2025, SWIFT fully transitioned to the ISO 20022 standard, completing a multi-year abandonment of the outdated MT format and changing the foundation of all international payments.

- The new standard uses XML messages with extended identifiers (LEI, UETR), which allowed automating up to 90% of operations and speeding up cross-border transfers to one day.

- Business and users received faster, cheaper, and more accurate transfers, with transparent payment tracking and a sharp reduction in errors and returns.

- The price of efficiency is a sharp increase in the volume of data collected about each transaction, including the complete chain of funds movement, participants, and detailed payment purpose.

- Financial privacy virtually disappears: regulators receive automatic access to transaction history, increasing the risk of data leaks, blockages, and behavioral analysis of clients.

- The response to total transparency is growing interest in privacy protection tools, including private cryptocurrencies and solutions like BitHide, allowing control over the level of financial data disclosure.

What is SWIFT and Why It Matters

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a secure network for exchanging financial messages between banks. It is not a payment system in the direct sense; money is not transferred through SWIFT. It is a communication protocol that allows one bank to inform another: «Transfer such-and-such amount to such-and-such recipient.»

The network connects more than 11,000 financial organizations in 200 countries. Without SWIFT, international transfers, currency operations, and trade financing are impossible.

Until November 22, 2025, SWIFT operated on two parallel standards: the old MT (Message Type) format, created in 1973, and the new ISO 20022, which began to be implemented in 2004. Now the old format has been completely decommissioned.

What Changed Technically

To understand the essence of the transition, we need to understand the differences between the two standards.

The old MT format worked like a telegram: short text fields with fixed tags. For example, tag :50K: designated the debtor (the one sending money), :59: the recipient, :32A: the amount and currency. Each field had a strict volume limitation, often up to 100 characters. Minimal information was transmitted: who, to whom, how much, bank code (BIC). No details about payment purpose, source of funds, or intermediate participants in the chain.

The new ISO 20022 format is built on XML (Extensible Markup Language). These are structured messages where each element has a clear hierarchy and can contain many nested fields. Instead of short tags, full names in English are used, understandable to both humans and computers.

New mandatory identifiers appeared in the new standard:

- LEI (Legal Entity Identifier) is a unique 20-digit code of a legal entity that allows unambiguous identification of a company or organization anywhere in the world.

- UETR (Unique End-to-end Transaction Reference) works like a tracking number for a package.

- Payment purpose information (Remittance Information) can now contain up to 140 characters of detailed payment purpose description.

The key technical difference is that the XML structure is automatically read by computers. Banking software can check the correctness of all fields according to predefined templates (XSD schemas), find errors before sending, and automatically process payments without operator involvement.

Why the Transition Happened Now

ISO 20022 development began back in 2004, but the full transition stretched over two decades. The reason is simple: replacing a communication protocol for 11,000 banks requires colossal investments in IT infrastructure, staff training, and system testing.

Since March 2023, SWIFT launched a transition period when banks could work in both the old MT and the new MX format (MX means messages in XML format). The system automatically converted formats when necessary but charged additional fees for conversion.

By November 2025, approximately 97% of all payments were already being processed in ISO 20022 format. Therefore, SWIFT announced the final date for turning off the old format. November 22 was the last day when MT messages were accepted by the system. From November 23, only ISO 20022 operates.

Advantages of the New Standard

Processing speed increased dramatically. Previously, an international transfer took three to five business days. Now, thanks to automatic processing (STP, that is, Straight-Through Processing), 90% of payments pass without human involvement. Funds arrive in minutes or within one business day.

Transaction costs decreased by 20-30%. Previously, a typical international transfer cost $20-50 in fees. The main part of these expenses was for manual work of correspondent bank operators.

Accuracy increased critically. In the old MT format, about 15% of payments required manual correction due to incomplete or incorrectly filled details. The receiving bank could not understand the payment purpose, requested clarifications, which stretched the process for days. In ISO 20022, structured fields and automatic verification by XSD schemas cut off most errors even before sending the message.

Transparency for business improved significantly. Companies now see payment status in real time through UETR tracking. You can track exactly which bank the money is in, when it will arrive to the recipient, what fees were withheld at each stage.

The effect on the economy as a whole is positive. Accelerating cash flows improves company liquidity, reduces risks of currency fluctuations (money arrives faster, the rate does not have time to change significantly), simplifies international trade.

What Changed for Regular Users

At the everyday level, the transition went unnoticed. If you sent a transfer through a bank's mobile application on November 22, and did the same on November 23, there were no visible differences. Visa and Mastercard cards work as before, domestic transfers are instant.

However, international transfers became noticeably faster. What previously took two to three days now completes in a few hours or by the end of the business day. You send money to a relative abroad in the morning, and by evening it's already in their account.

Delays due to technical errors decreased. Previously, a bank could return a payment in three days with the wording «incorrect IBAN» or «insufficient information about the recipient.» Now the system checks data correctness immediately upon entry, and if something is wrong, you learn about it before sending, not after several days of waiting.

The main change, which is not yet obvious, is related to data.

The Flip Side: The End of Financial Privacy

This is where serious problems begin. ISO 20022 was created with an emphasis on transparency and combating financial crimes. Each transaction now contains an extensive data set that is available not only to banks but also to regulators.

What exactly is recorded in the new format:

- Complete chain of money movement. The UETR identifier allows tracking every step of a payment: from which bank funds left, through which intermediate banks they passed, where and when they arrived at the recipient's account.

- Identification of participants through LEI. Companies and organizations are identified not just by name but by a unique international code. The system knows who really stands behind each transaction.

- Payment purpose in details. The Remittance Information field requires an exact description of what the money is being paid for. Previously, you could simply write «payment for services,» now banks require specifics: contract number, product name, document reference.

- Transaction risk assessment. Risk markers for money laundering or terrorism financing are embedded in the message. Automatic systems analyze each transfer and assign it a risk rating.

All this data is stored indefinitely for compliance purposes, that is, compliance with anti-money laundering (AML) and customer identification (KYC) requirements. Financial regulators have access to this data within the framework of FATF recommendations.

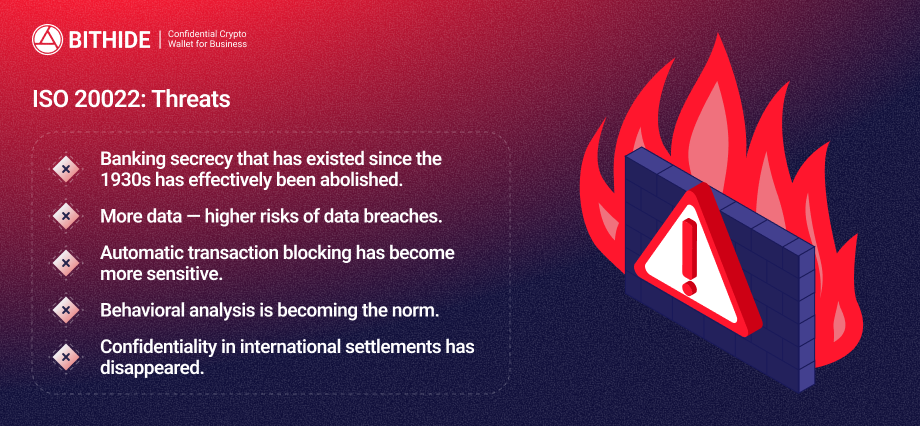

What this means for privacy:

1. Banking secrecy, which existed since the 1930s, is effectively abolished.

Previously, the details of your financial transactions were confidential; the bank could not disclose them to third parties without your consent or a court decision. Now regulators receive access to the complete transaction history in automatic mode.

2. More data means more leak risks.

All transaction details are now stored in one XML file. If hackers breach the database, they will receive not just a list of transfers but a complete picture of your finances with explanations of what and to whom you paid for.

3. Automatic blocking of operations became more sensitive.

Risk analysis systems operate by algorithms that sometimes make mistakes. A regular transfer to a relative in another country can be blocked if the amount seems suspicious to the system or the recipient is in a high-risk region.

4. Behavioral analysis becomes the norm.

Banks now see not just the fact of a transfer but also the context: to whom you pay regularly, what purposes you spend money on, how your financial habits change. This information is used for scoring (creditworthiness assessment), targeted advertising, and in some countries can be transmitted to government agencies.

5. Global financial control.

Through the unified ISO 20022 standard, data on all international payments flows into centralized monitoring systems. Confidentiality in international settlements has virtually disappeared.

Connection with Cryptocurrencies and Blockchain

It is important to understand that ISO 20022 is not a blockchain technology. However, its XML format is designed so that it can serve as a bridge between the banking system and cryptocurrency platforms.

Several blockchain projects have adapted their protocols for compatibility with ISO 20022:

- Ripple (XRP) uses this standard for integration with banks, offering fast international transfer technology.

- Stellar (XLM) is focused on money transfers in developing countries, especially in Africa. The partnership with MoneyGram, which covers operations worth about $300 million, operates through ISO 20022-compatible channels.

- Algorand (ALGO) participates in pilot projects for central bank digital currencies (CBDC, Central Bank Digital Currency) in Italy and other countries.

- Quant (QNT) develops solutions for interoperability, allowing different blockchains to exchange data through ISO 20022.

- Hedera (HBAR) focuses on corporate tokenized assets, using the standard for integration with banking systems.

ISO 20022 itself does not change anything in the nature of cryptocurrencies. But it creates a technical possibility for banks to work with crypto assets through familiar SWIFT channels. This accelerates the conversion of fiat to cryptocurrency and back, lowers barriers for institutional investors, but simultaneously adds regulatory control over crypto transactions.

Financial Control and Privacy Protection

The new standard creates what can be called a financial panopticon. Each of your transactions forever leaves a digital trace. The users' response is predictable; interest in privacy tools is growing:

- Private coins (for example, Monero, Zcash), which use cryptographic methods to hide the sender, recipient, and transfer amount, zero-knowledge proofs.

- Payment solutions with built-in privacy protection. In BitHide, clients independently decide how private a specific transaction will be by choosing one of the Transaction Security Levels.

Regulators also sense market demand; the SEC held a roundtable on user privacy protection issues.

Conclusion

ISO 20022 has become the foundation of the financial architecture of the future. XML messages with UETR and LEI identifiers integrate traditional banks, central bank digital currencies, and blockchain platforms into a single global network.

This speeds up payments, reduces costs, and decreases errors. But you have to pay for efficiency with privacy. Banking secrecy, which protected citizens' private lives for almost a century, has been effectively abolished. The ability to program conditions for money use creates risks of political control and social engineering.

In an era of total financial transparency, privacy protection tools become not a luxury but a necessity. BitHide offers proven solutions for those who value freedom, confidentiality, and security.

Contact us right now, get a free consultation on Transaction Security Levels and choose the appropriate method to protect your business's sensitive da