No address blocks due to risky assets in six months with BitHide’s AML checks

Know your cryptocurrency's risk score to manage it effectively.

How to accept cryptocurrency from clients without worrying about its risk level or address blocking. An online casino has found the perfect solution with BitHide's business crypto wallet, equipped with a built-in AML check tool.

The Challenge

An online casino needed a business crypto wallet to accept cryptocurrency payments from clients. The solution had to meet several requirements:

- Seamless API Integration with the casino's website, allowing players to deposit funds directly to the company's wallet.

- Automated Address Generation to eliminate manual input and reduce errors, making it easier to identify payments from specific clients.

- Integrated AML Risk Assessment to evaluate the risk score of cryptocurrencies. Some players used the casino to improve the "cleanliness" of their cryptocurrency by depositing “dirty” crypto, playing a little, and withdrawing "cleaner" funds. Accurately identifying risk levels was crucial.

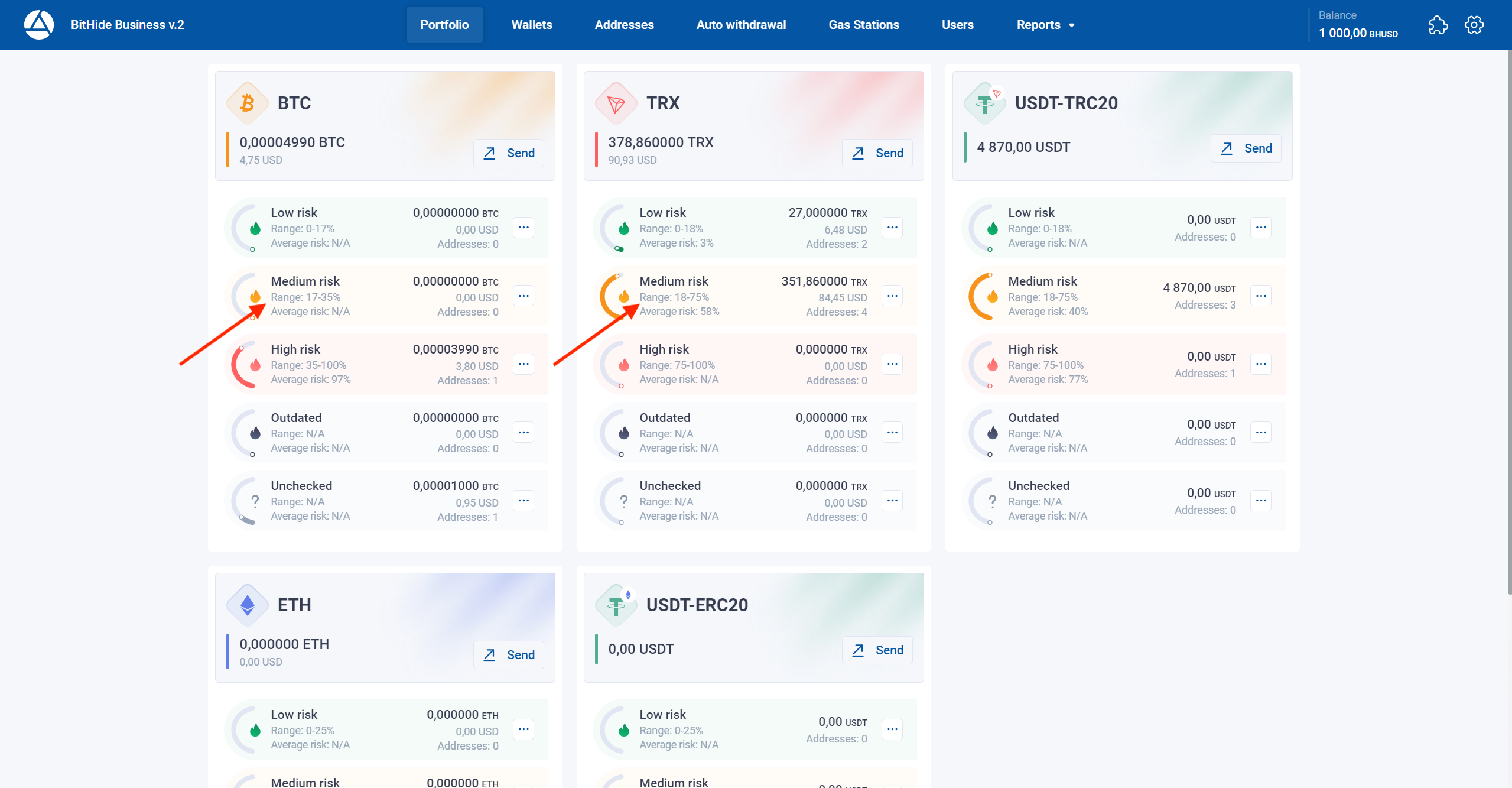

- Sub-Wallet Creation to separate cryptocurrencies by risk level. High-risk assets could be stored separately from low-risk ones, ensuring no intermingling.

AML (Anti-Money Laundering) principles combat money laundering and ensure compliance with regulations.

The Solution

The casino partnered with the BitHide team, explaining its specific needs. BitHide's product exceeded expectations, offering standard features like API integration, unlimited sub-wallets, and automated payment address generation, along with a built-in AML check for USDT and other cryptocurrencies.

In addition, the user can set up automatic risk checking when crediting assets or check the required addresses manually. For automatic checking, you can set a minimum transaction amount to exclude minor receipts.

The BitHide client can also define their own risk thresholds for different cryptocurrencies. For example, BTC assets with a risk score above 80% and USDT assets above 60% are considered high-risk.

The Results

Six months after integrating the wallet with its website, the casino provided feedback.

No Address Blocks: Over six months, the company experienced no address blocks, ensuring that all its cryptocurrency remained accessible. This was achieved thanks to BitHide's integrated AML check tool.

Streamlined Risk Management: All incoming assets are automatically assessed and categorized into separate wallets based on risk level, enabling the company to make informed decisions on handling high-risk assets.

Ready to Perform AML Checks Directly in Your Crypto Wallet? Gain full control over your assets and protect your business from unscrupulous players. Become a BitHide client today— visit our website to learn more about our product's capabilities!